Disclaimer : These are purely my thoughts about the equity market and do not take this for investment advice.

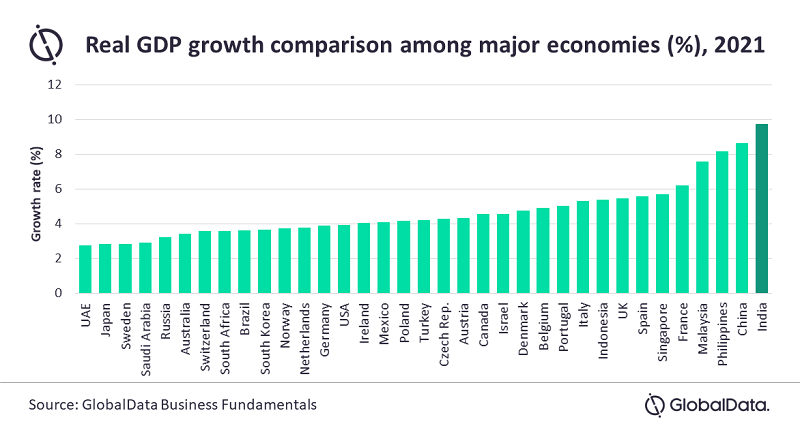

In the Macro sense , the difference between bond yields between the US and India have historically gone down . Now this means that the pace of growth of a country like India has remained stable while that of a developed nation i.e the leader of nations USA has become volatile. Now does this mean going ahead we will see the same trend ? History has shown that a country which is the superpower of previous times eventually becomes less powerful. One of the indicators to it are decreasing bond yield difference between it and developing nations.

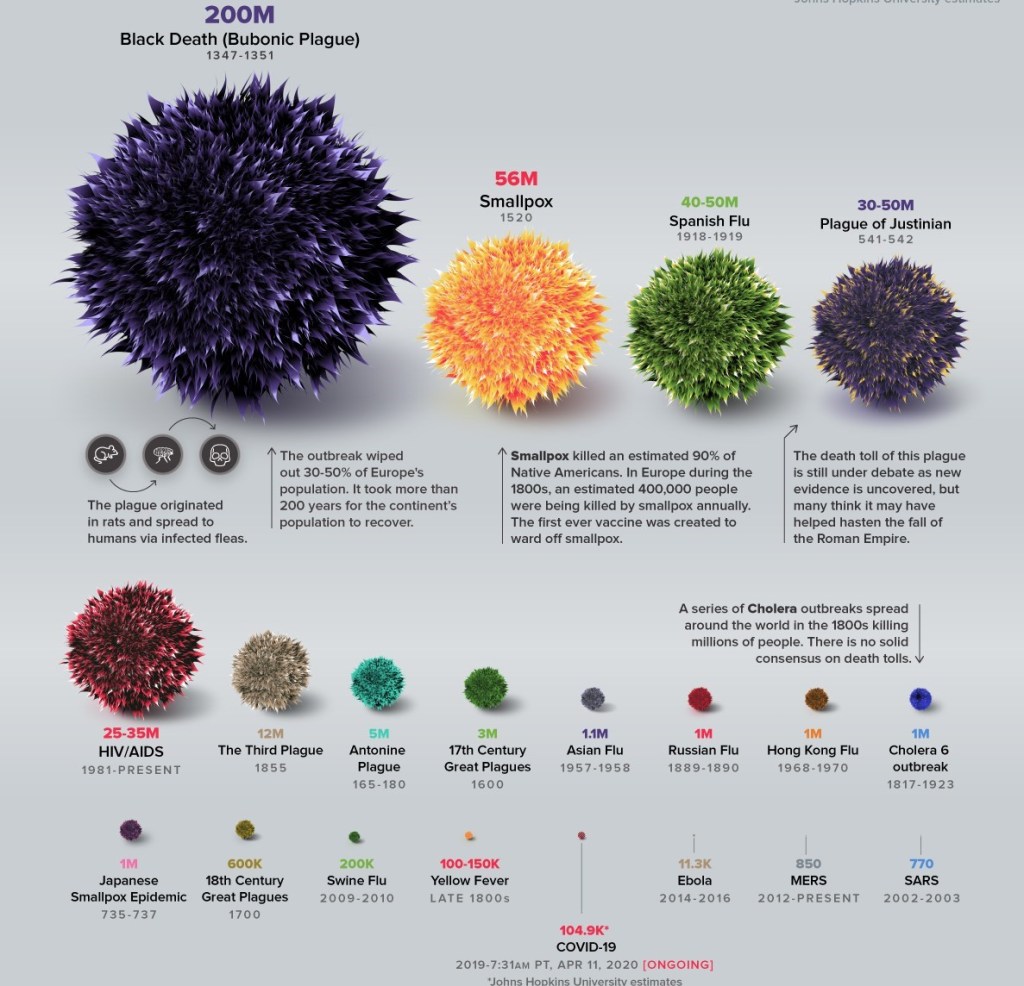

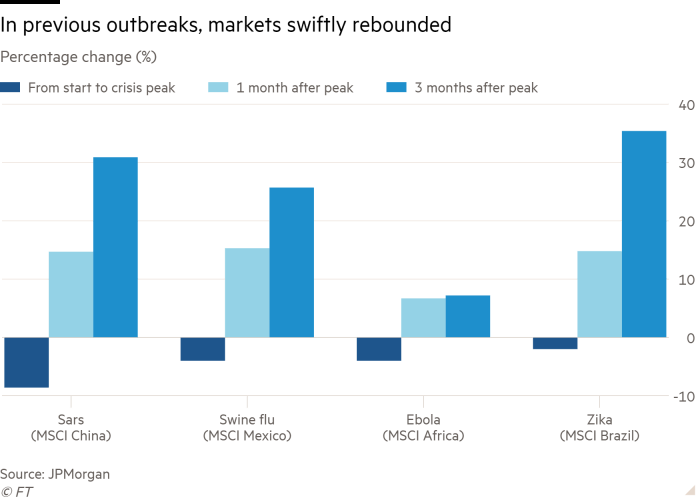

With reference to the Indian scenario, the world is a smaller place because of globalization that took place in the last century and the countries are interwoven with each other. Growth becoming slower in a country which is not yours, will have an effect on the growth of your country. Hence this does affect factors like Oil Prices, Demand, Commodity prices which will in turn affect the raw material prices of various goods, increase debt in the overall country and thus leading to lower growth. Hence we cannot infer that a slowdown somewhere else will not affect us. Now this will affect the returns of your funds in the short to medium term.

When it comes to bottom up picking i.e picking individual stocks, i’d say even though valuations are slightly high. There are companies which are brilliantly run. I’m constantly amazed at the ways some promoters allocate cashflows to be at the forefront in their industries and investing in such companies are a sure shot way to get reach, keeping in mind that investing is a full time job and being aware of how businesses work just decreases your risk over time.

Hence even though the markets look slightly riskier , but the opportunities do remain, although fewer.